Livewire | The biggest risk to markets (and 3 stocks to keep portfolios afloat)

This article was first published by Ally Selby in Livewire Markets on 21 June, 2023.

The next 12 months are likely to be difficult for corporate earnings, both Australia and the US are likely to suffer significant economic downturns, and geopolitical tensions continue to make matters worse.

According to L1 Capital’s Mark Landau, all these signs point to one thing – now is the time to reduce market exposure.

Speaking at the Bell Potter VOICES conference, Landau warned that investors face headwinds from all fronts – including industrial relations, energy security and government policy.

This comes as high P/E stocks soar to more than 20-year highs, and defensives continue to receive the lion’s share of both retail and institutional capital.

But before you curse the world’s central banks and give up completely, there is a caveat to the above statements. Landau does believe there to be “extreme opportunity” in a particular area of the market: Low P/E stocks.

In this wire, I’ll summarise Landau’s tips for navigating today’s market, why he is avoiding many of the stocks the market has crowded into, as well as three of his favourite names right now to help keep portfolios afloat.

The biggest risk to markets over the next 12 months

Landau is cautious on the market outlook and believes valuations are looking relatively full. He argues that the risk-reward for investing in equities markets is worse than it has been in years, and thus – for those that can, he notes that now would be an opportune time to reduce market exposure.

“You’ve been through this period over the last few years where earnings have consistently beaten expectations, as companies enjoyed the benefits of massive stimulus from governments and central banks, and effectively revenues and earnings were bouncing back really fast.”

But the next 12 months look far more sobering. Landau believes we are likely to see companies suffering the crunch on the earnings front. And while this concern has been well documented when it comes to the retailers, the L1 Capital team believes it is likely to be much more widespread.

“The geopolitical tensions are much more elevated than they have been for the last few years (China-Taiwan, Russia-Ukraine, Middle East)… [and] government policy has been a headwind for many corporates. So we’re seeing pressure from an industrial relations point of view, from an energy policy perspective, and a lack of immigration until more recently,” he added.

Defensives and growth stocks aren’t as safe as you would think right now

As it stands today, investors are concentrated in a handful of defensive and high P/E names. In fact, a recent JP Morgan global fund manager survey found that 56% of fund managers believe defensives are the best place for investors’ capital today.

“Only 2% said cyclicals and because of that the valuations of cyclical stocks at the moment look incredibly attractive,” Landau says.

“For the ASX 200, offshore earners – which typically fall into the healthcare or technology space – are trading at the 96th percentile in terms of their average PE versus their decade average… Defensives [are trading at the] 91st percentile and low-risk stocks are trading close to the 80th percentile.”

Meanwhile, low P/E and resources companies are “by far the cheapest” they have been in some time. Low P/E stocks are trading at the 7th percentile in terms of the decade average, while energy and materials are trading at the 16th-18th percentile.

“That’s really where we’re searching for opportunity,” Landau says.

Source: Bell Potter VOICES conference / L1 Capital.

If you look at the chart above, you can see that low P/E stocks are currently trading at multiples not since the GFC and before that the dot-com bubble. Meanwhile, high P/E stocks haven’t been this expensive for more than 20 years.

“This is the 75th percentile of most expensive stocks in the market. It’s not skewed by the top five or six companies that might be trading on 100 or 1000 times earnings. This is based on the median 75th percentile,” Landau explains.

“So you’re getting this really extreme opportunity.”

With this in mind, Landau and his team are investing in low P/E stocks in their long book, and shorting higher P/E stocks. The average long position in the portfolio has a P/E ratio of nine times. The average short position in the portfolio has a P/E of over 21 times.

Three of L1 Capital’s top stock picks for today’s markets

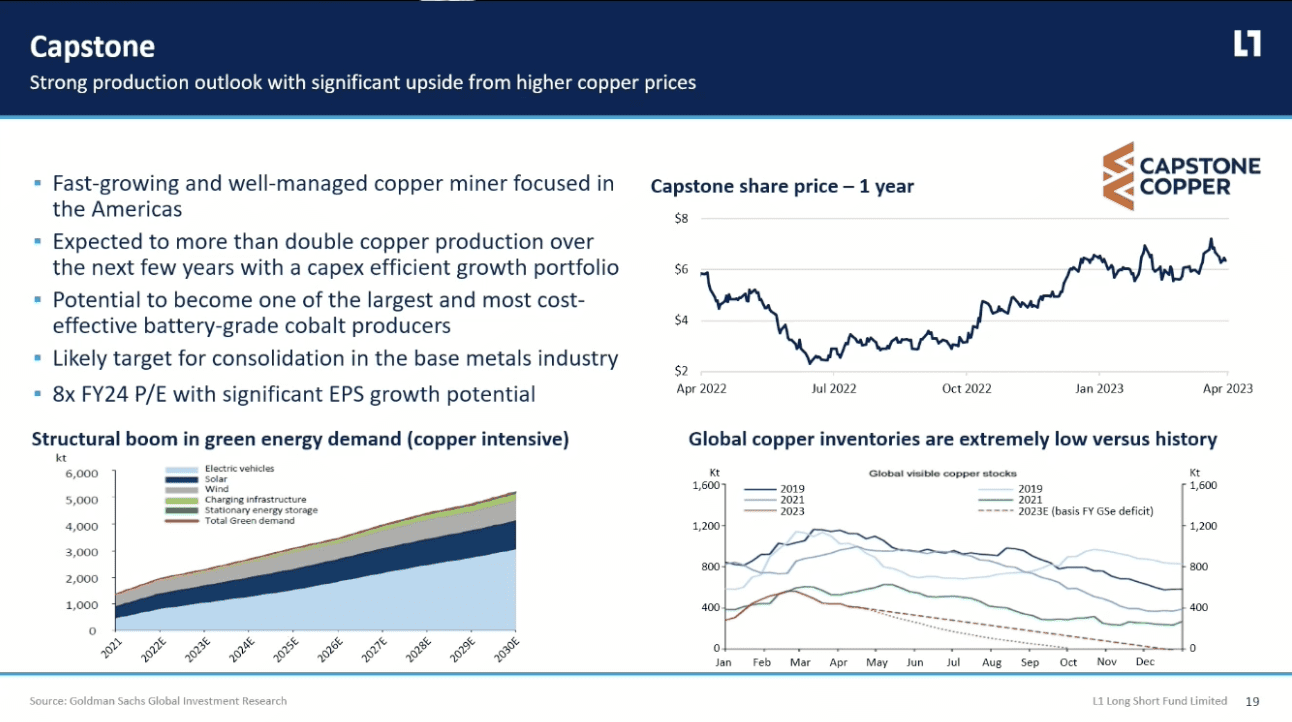

Capstone Copper (TSE: CS)

Source: Bell Potter VOICES conference / L1 Capital.

Capstone is a copper company listed in Canada with a market cap of CAD$4.33 billion. Over the past 12 months, its share price has lifted 41%. It’s currently trading on a P/E of eight times.

Landau is bullish on the outlook for copper – which he notes is used extensively in electric vehicles, solar farms, wind farms, and charging stations. As seen in the bottom right chart above, global copper inventories are extremely low versus history, making for favourable supply-demand dynamics for the base metal.

“It has an exceptional outlook,” Landau says.

Landau and his team also believe Capstone has the potential to become one of the largest and most cost-effective cobalt producers in the world.

“They’ve currently got a waste product that’s going to be refined into cobalt and we think the market is paying nothing for that at the moment,” he says.

“The shares are currently trading around CAD$6 and we think, using conservative copper price assumptions going forward, there’s comfortably a 70% to 100% upside in that stock over the next couple of years as they deliver on their production growth.”

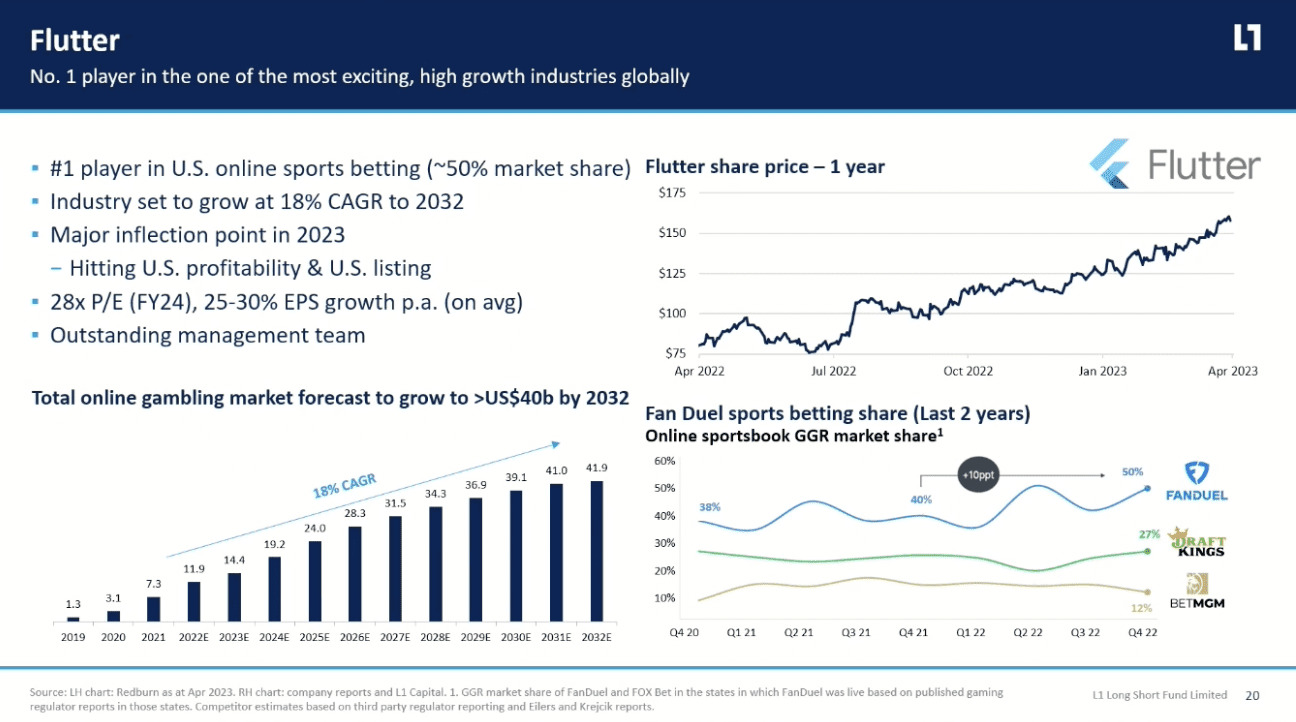

Source: Bell Potter VOICES conference / L1 Capital.

Followers of Landau and his team will know that L1 Capital has been bullish on the outlook for Flutter for quite some time.

"We think the industry is likely to quadruple in size over the next seven years."

Landau likens the opportunity in Flutter to investing in REA Group or Seek 10 to 20 years ago, noting that in an industry that is set to grow massively, the number one player typically wins “a disproportionate share of industry profits”.

“Once you’ve built your technology platform, once you’ve done your marketing, once you’ve paid your staff, all the incremental revenue goes to the bottom line,” he says.

“So the number one player tends to win by far the highest margins… They’re by far the number one and we think they’re incredibly well-positioned to benefit from the structural growth you’re likely to see in that industry.”

Imdex (ASX: IMD)

Source: Bell Potter VOICES conference / L1 Capital.

Imdex is an ASX-listed mining exploration drilling company, which the team at L1 Capital has been backing since late 2016. Since their initial investment, the stock’s share price has risen more than 200%.

"Essentially, Imdex is the global leader in tools for mining exploration drilling. It was already by far the number one and recently acquired the number two player so they've cemented their position as the dominant and by far the best player in mining exploration."

In fact, close to 60% of the largest mining companies around the world currently use Imdex’s software platform to track their drilling activity in real time, he says.

On top of this, Landau is backing Imdex’s “proven management” team and the company’s growth outlook – despite the fact the “industry hasn’t been growing for the last five years.”

“While exploration activity is subdued today, we think we’re likely to hit an inflection point in drilling activity in the next one to two years, given rising demand for lithium, copper, nickel, and even gold that we think are all about to enjoy structural growth. Imdex has also developed some fantastic new products that they’re just starting to launch.”

Additional resources

Learn more about the L1 Capital Long Short Strategy