Livewire | 5 key themes L1 Capital likes in a challenging market

This article was first published by Sara Allen in Livewire Markets on 24 November, 2023.

There’s a general malaise when it comes to investing at the moment, and no real wonder as to why. A year ago, we were battling persistent sticky inflation – and it’s still here. A year ago, we were watching interest rates rocket up and we’ve just copped another hike – a Melbourne Cup special, no less. We’ve seen energy prices continue to go up and up. And the predicted slowdown and recession keep getting pushed out further and further.

Investors could be forgiven for viewing the market as overwhelming, giving the perpetual uncertainty and the signals that consumers and businesses alike are feeling the pinch. After all, as Mark Landau, Joint Managing Director and Co-Chief Investment Officer of L1 Capital, pointed out in a recent investor webinar on the L1 Capital Long Short Strategy that the ASX 200 is currently trading in line with its 20-year average P/E multiple.

On the surface, that sounds like it is fair value; not much to see here. But a peek below the headline number reveals major distortions and mispricings according to Landau. It’s a rich opportunity set for the contrarian investor.

A market of extremes

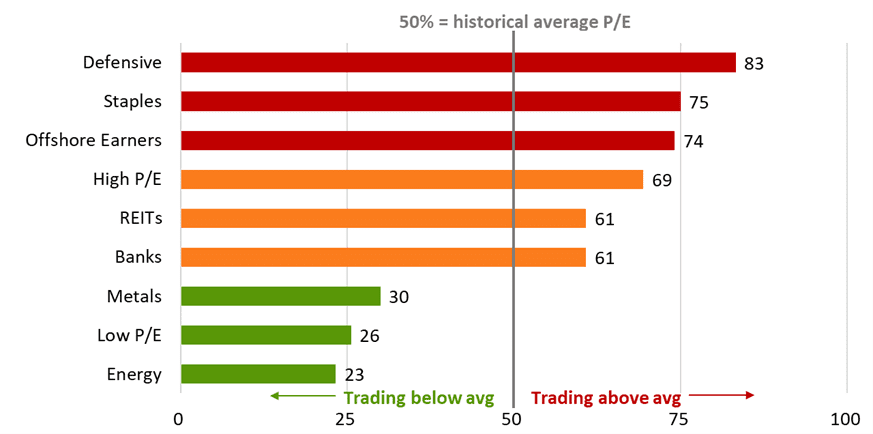

“Valuations are looking mixed beneath the surface and there is a lot of dispersion”, says Landau.

“At a sector level, Industrials are trading well above the 20-year average with an almost 20% premium, while Resources are at a 20% discount to 20-year averages.”

Landau believes that Industrials are likely to slow but is bullish on Resources. Resources have had a difficult period, hurt by their leverage to a subdued Chinese economy, but China is now starting to implement more stimulus.

Where things get more interesting – or concerning, depending on your perspective is in low P/E vs high P/E stocks.

For example, low P/E stocks are trading at the cheapest they have in 30 years, at the same time that high P/E stocks are at their most expensive level in three decades. It is a market of extremes.

Landau notes that low P/E stocks have only traded this cheaply twice in the last 30 years – during the dotcom bubble and the GFC. In both instances, it turned out to be a buying opportunity with these stocks outperforming significantly thereafter.

High P/E stock valuations are also comparable to the dotcom boom – in fact, they are trading at around a 73% premium to the market.

Across the market, L1 Capital is seeing more opportunities in Low P/E, Energy and Metals stocks, while steering away from Defensives, Staples and Offshore Earners, which are looking expensive.

ASX 200 valuation premium of selected sectors/factors relative to historical ranges | 12m forward P/E vs. 10-year range (percentile rank versus history)

Source: Source: L1 Capital using Goldman Sachs Investment Research and Factset data as at 24 October 2023.

Five key themes and stocks

In the wake of the distortions that the team sees in the market, there are five key themes it has identified and is actively investing the L1 Capital Long Short Strategy in.

1. Energy

The combination of decades-long underinvestment in new energy supply paired with continually growing energy demand, including an expected recovery in Chinese aviation activity, has L1 Capital bullish on the prospects for the Energy sector. Despite these dynamics, which are clearly poised to push prices up, hedge funds and investors alike are relatively bearish about the outlook for oil – to the same extent they were back in 2020 during covid lockdowns and negative oil prices.

Two of the stocks L1 Capital favour on this front are Santos (ASX: STO) and Cenovus (NYSE: CVE).

The investment manager believes that Santos’ LNG assets are underappreciated and consensus estimates are pointing to 22% growth in earnings over the next three years – yet it is trading at a 35% discount to its US peers. Similarly, L1 Capital Senior Investment Analyst Amar Naik noted during the webinar presentation that integrated energy company Cenovus has an “exceptional portfolio of long-life assets and a low cost of production”.

2. Global leaders

This theme is focused on investing in the top players in structurally growing industries, with high-quality management teams.

Two of the companies L1 Capital favours in this space include construction materials company CRH (NYSE: CRH) and sports betting company Flutter (LON: FLTR). Both are global leaders in their sectors.

Naik notes that CRH is exposed to the huge infrastructure spend in the US and has $200bn already committed to projects. It is currently trading at 11x FY24 earnings, while competitors are trading at 20-25x.

As for Flutter, Naik view it as a best-in-class company in its field.

3. Gold

For L1 Capital, using gold is a valuable diversifier for the portfolio, providing hedging against geopolitical risk, inflation, and potential weakness in the US dollar. On top of that, the companies they are invested in are providing strong growth in production and leverage to higher gold prices.

The exposures they highlight include, in the large-cap space, Newmont (ASX: NEM), now the largest gold producer in the world by a wide margin and which also has strong copper exposure. Its acquisition of Newcrest is expected to drive strong upside from synergies over the next two years. Landau also spotlights small-cap play Westgold Resources (ASX: WGX), where cashflow is expected to benefit from robust production growth coupled with a very attractive Aussie dollar gold price.

4. Hidden tech

L1 Capital has identified a number of companies that are trading on low multiples that on the surface may not appear as exciting as some of their peers but have valuable embedded technology capabilities and solutions that drive their structural long-term earnings growth.

Take, for example, Imdex (ASX: IMD) which is a leader in mining exploration drilling technology or Nufarm (ASX: NUF) which has a crop protection business and seed technologies division. The seed technology segment has grown close to 40% pa over the past three years and L1 Capital is particularly excited about the potential of the proprietary Omega 3 technology.

5. Infrastructure

L1 Capital prefer businesses in the infrastructure space that are monopolistic, regulated assets with huge barriers to entry.

Two examples include Chorus (ASX: CNU) and Aurizon (ASX: AZJ).

Chorus owns and operates the majority of New Zealand’s high-speed broadband infrastructure and has just completed its decade-long investment in its fibre network. The L1 Long Short team believes this will mean a decline in Chorus’ capex and that there is strong potential for the dividend yield to accelerate.

Aurizon is the leading rail operator in Australia with over 5,000km of network rail assets. They see a number of drivers for a positive earnings outlook.

Bullish and contrarian for the future

While the normal wisdom is to go defensive in uncertain times, L1 Capital suggests that, particularly when valuations are stretched, doing the bottom-up work can turn up some excellent contrarian opportunities. The themes L1 Capital has identified also tie into major concerns and trends of our times, meaning plenty of structural room to move and a range of companies to explore.

Perhaps the market is looking a bit more exciting than general sentiment suggests – you just have to have a good look beneath the surface.

Additional resources

Learn more about the L1 Capital Long Short Strategy